09 Nov

In today’s rapidly evolving financial landscape, the concept of decentralized finance, or DeFi, has been gaining significant attention. With the rise of cryptocurrencies and blockchain technology, DeFi aims to offer an alternative financial system that is more transparent, efficient, and accessible to everyone. One of the critical components of this emerging field is decentralized prime brokerage, which enables users to trade financial assets in a peer-to-peer manner without the need for intermediaries.

A decentralized prime brokerage brings together various financial tools and services to provide a comprehensive and integrated trading experience. However, what sets it apart from traditional prime brokerage services is the use of decentralized technologies such as blockchain, smart contracts, and decentralized applications (dApps) to enable instant settlement, reduce counterparty risk, and ensure transparency.

In this article, we will delve into the building blocks of a decentralized prime brokerage, including the EIP protocols, SAFE protocols, liquidity pools, AMMs, RFQ, order books, PMMs, and the prediction of demand. These building blocks form the backbone of the decentralized prime brokerage, and understanding how they work is critical to unlocking the full potential of DeFi.

What is a Decentralised Prime Brokerage?

A prime brokerage is a specialized financial service provided by large investment banks to hedge funds, asset managers, and other institutional investors. It offers a range of services, including securities lending, margin financing, and clearing and settlement. These services enable hedge funds and other large investors to execute complex trading strategies and manage their risk exposure efficiently.

However, traditional prime brokerage services are limited to institutional investors with large capital bases, leaving individual investors with limited access to such services. This is where decentralized prime brokerage comes in, which aims to provide the same level of services to individual investors, but with a decentralized and trustless approach.

Decentralized prime brokerage leverages the power of blockchain technology, smart contracts, and dApps to provide instant settlement, reduce counterparty risk, and ensure transparency. By using these cutting-edge technologies, decentralized prime brokerage eliminates the need for intermediaries, such as banks and clearinghouses, which can add delays and costs to the trading process.

In addition to enabling individual investors to access prime brokerage services, decentralized prime brokerage also has the potential to transform the financial system as a whole. It can create a more open and transparent financial system, free from the limitations of traditional centralized institutions. It can also democratize finance by providing access to financial services to underserved communities around the world.

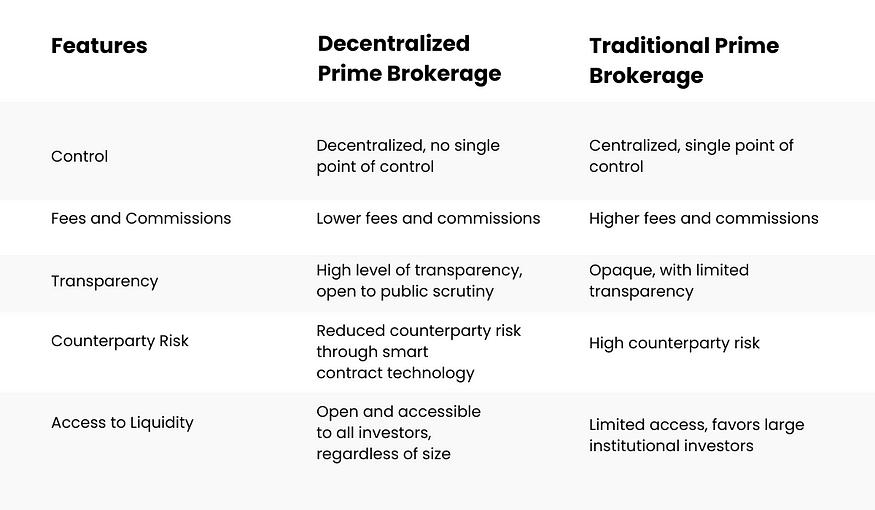

Decentralized vs Traditional Prime Brokerage

Features Decentralized Prime Brokerage Traditional Prime Brokerage Control Decentralized, no single point of control Centralized, single point of control Fees and Commissions Lower fees and commissions Higher fees and commissions Transparency High level of transparency, open to public scrutiny Opaque, with limited transparency Counterparty Risk Reduced counterparty risk through smart contract technology High counterparty risk Access to Liquidity Open and accessible to all investors, regardless of size Limited access, favors large institutional investors

Building Blocks of Decentralized Prime Brokerage

EIP Protocol :

Decentralized prime brokerage platforms aim to provide users with greater control and ownership of their assets while maintaining the security and transparency of the blockchain. EIP plays a crucial role in this ecosystem by providing a standardized method for encoding and signing messages, which are used to authenticate and authorize various actions within the platform.

Imagine you want to use a digital wallet to manage your transactions and payments, but you also want to have more control over the specific transactions you can make. The development of EIP-2938, which is a technical proposal for the Ethereum blockchain, allows you to do that by creating a smart contract wallet.

This smart contract wallet is like a digital wallet, but it also has some additional features. It includes logic that allows you to pre-approve certain transactions with specific amounts. For example, you can set it up to only allow transactions of up to $100 or only to certain addresses. This gives you more control over how your digital wallet can be used.

When you want to make a transaction, the smart contract wallet checks if the transaction meets the criteria you pre-approved. If it does, the transaction is allowed to proceed. You can also set the gas price and gas limit for the transaction, which determines the fees you are willing to pay for the transaction to be processed.

This smart contract wallet can be deployed on the Ethereum blockchain, which is a decentralized network that allows for transactions and interactions without the need for intermediaries like banks. By using this smart contract wallet, you can have more control over your transactions and payments in a decentralized and secure way, without relying on traditional financial institutions. This has the potential to enhance the functionality and flexibility of decentralized finance (DeFi) protocols and applications, offering new possibilities for managing your digital assets.

SAFE Protocols :

SAFE protocols are a set of DeFi protocols that provide a secure and transparent way for investors to pool their assets and invest in various financial products. These protocols are based on the Ethereum blockchain and use smart contracts to facilitate asset pooling, investment, and distribution of returns.

SAFE protocols operate by creating a smart contract that governs the terms of the asset pool. Investors can pool their assets into the contract, and the contract automatically distributes the returns according to the predetermined terms. The contract is transparent, meaning that investors can track the assets in the pool and the distribution of returns.

SAFE protocols enhance security and trust in transactions by providing a transparent and immutable record of all transactions. The protocol is based on the Ethereum blockchain, which is a decentralized and distributed ledger that is resistant to manipulation or hacking. This means that all transactions are recorded accurately and cannot be altered or tampered with.

Furthermore, the protocol uses smart contracts to execute transactions automatically, which reduces the risk of fraud or human error. Since the contracts are transparent and auditable, investors can be sure that their assets are being managed correctly and that the returns are being distributed fairly.

Liquidity Pools and AMMs :

Liquidity pools and automated market makers (AMMs) are essential components of decentralized finance (DeFi) that provide a decentralized way for investors to trade cryptocurrencies and other assets.

How it Works :

Liquidity pools are pools of funds that are provided by investors who wish to earn a return by providing liquidity to the market. In return, investors receive a portion of the fees generated by the pool. AMMs are algorithms that use the funds in the liquidity pool to automatically set the price of assets based on supply and demand. The price of the asset is adjusted automatically based on the amount of liquidity in the pool and the number of orders placed.

Liquidity pools and AMMs facilitate trading in decentralized prime brokerage by providing a way for investors to trade cryptocurrencies and other assets without the need for a central authority. Investors can trade assets directly with other investors, and the liquidity provided by the pools ensures that there is always a market for the asset.

In addition, liquidity pools and AMMs provide a more efficient way to trade assets compared to traditional exchanges. Since there is no need for a central authority to match buyers and sellers, trades can be executed more quickly and at a lower cost.

Liquidity pools and AMMs ensure liquidity and reduce slippage in trading by providing a decentralized way for investors to trade assets. Since the pools are constantly adjusting the price of the asset based on supply and demand, there is always a market for the asset, and trades can be executed quickly and efficiently.

Furthermore, the liquidity provided by the pools ensures that there is always a sufficient supply of the asset, which reduces slippage in trading. Slippage refers to the difference between the expected price of an asset and the actual price at which the trade is executed. With sufficient liquidity in the pool, slippage can be minimized, ensuring that investors receive the expected price for their trades.

Predictive Market Making :

Predicative Market Making (PMM) is an advanced trading strategy used by market makers to provide liquidity for traders in DEXs. Market making involves buying and selling assets in a market to create liquidity, which enables traders to buy and sell assets easily. In traditional market making, market makers profit from the spread between the bid and ask prices. However, in PMM, market makers use predictive algorithms to anticipate future market movements and adjust liquidity provision accordingly.

PMM algorithms are designed to analyze market data, such as order book depth, trading volume, and price history, to predict future market trends. These algorithms are often based on machine learning models that can learn from historical market data to make more accurate predictions.

1. Adaptable to Changing Market Conditions :

PMM algorithms can adapt to changing market conditions in real-time, providing more accurate pricing and reducing the risk of market manipulation. This can help ensure that traders are getting the best possible prices for their trades, regardless of market conditions.

2. Transparent Pricing :

PMM provides more transparent pricing for traders, increasing confidence in the accuracy of the prices they see. This can help reduce the risk of market manipulation and ensure that traders are getting a fair deal on their trades.

3. More Efficient Trading :

PMM can help make trading more efficient by reducing the impact of slippage and other trading costs. This can help improve the overall trading experience for users of DEXs, making them a more attractive alternative to centralized exchanges.

RFQ and Order Books :

In decentralized prime brokerage, Request for Quote (RFQ) and order books are critical components that enable investors to trade assets with transparency, fairness, and efficiency.

How it Works?

RFQ is a process in which an investor requests a quote for a specific asset from a liquidity provider or a broker. The quote includes the price at which the asset can be bought or sold and the quantity available. Order books, on the other hand, are a record of all the buy and sell orders placed by investors for a specific asset.

RFQ and order books play a crucial role in decentralized prime brokerage as they provide transparency, fairness, and efficiency in trading. They enable investors to access a wide range of liquidity providers and brokers and compare quotes to ensure they receive the best possible price for their trades.

RFQ and order books facilitate trading by providing investors with a transparent and efficient way to access liquidity providers and brokers. By requesting quotes from multiple providers, investors can compare prices and ensure they receive the best possible price for their trades. Furthermore, order books provide a record of all the buy and sell orders, which ensures that trades are executed fairly and efficiently.

In addition, RFQ and order books ensure fair pricing for all parties involved in the trade. The transparent nature of the process ensures that investors receive the best possible price for their trades, while liquidity providers and brokers can compete on a level playing field to provide the best possible price for their services.

Conclusion

Decentralized prime brokerage is a game-changing concept that has the potential to revolutionize the financial industry. By leveraging blockchain technology and decentralization, decentralized platforms offer unparalleled transparency, security, efficiency, and cost savings. As the financial industry continues to evolve, decentralized prime brokerage will play an increasingly important role in democratizing finance and empowering individuals and communities around the world.

The future of decentralized prime brokerage is bright, with increasing adoption of blockchain technology and decentralization in the financial industry. Decentralized platforms offer a new model for financial services that is more efficient, transparent, and accessible, ultimately empowering individuals and communities around the world. As the technology continues to evolve, we can expect to see greater innovation and integration of decentralized prime brokerage into the broader financial ecosystem.