Dubai, September 17, 2024

Dubai, September 17, 2024

Dexponent CESR Staking & Derivatives.

Dexponent CESR Staking & Derivatives.

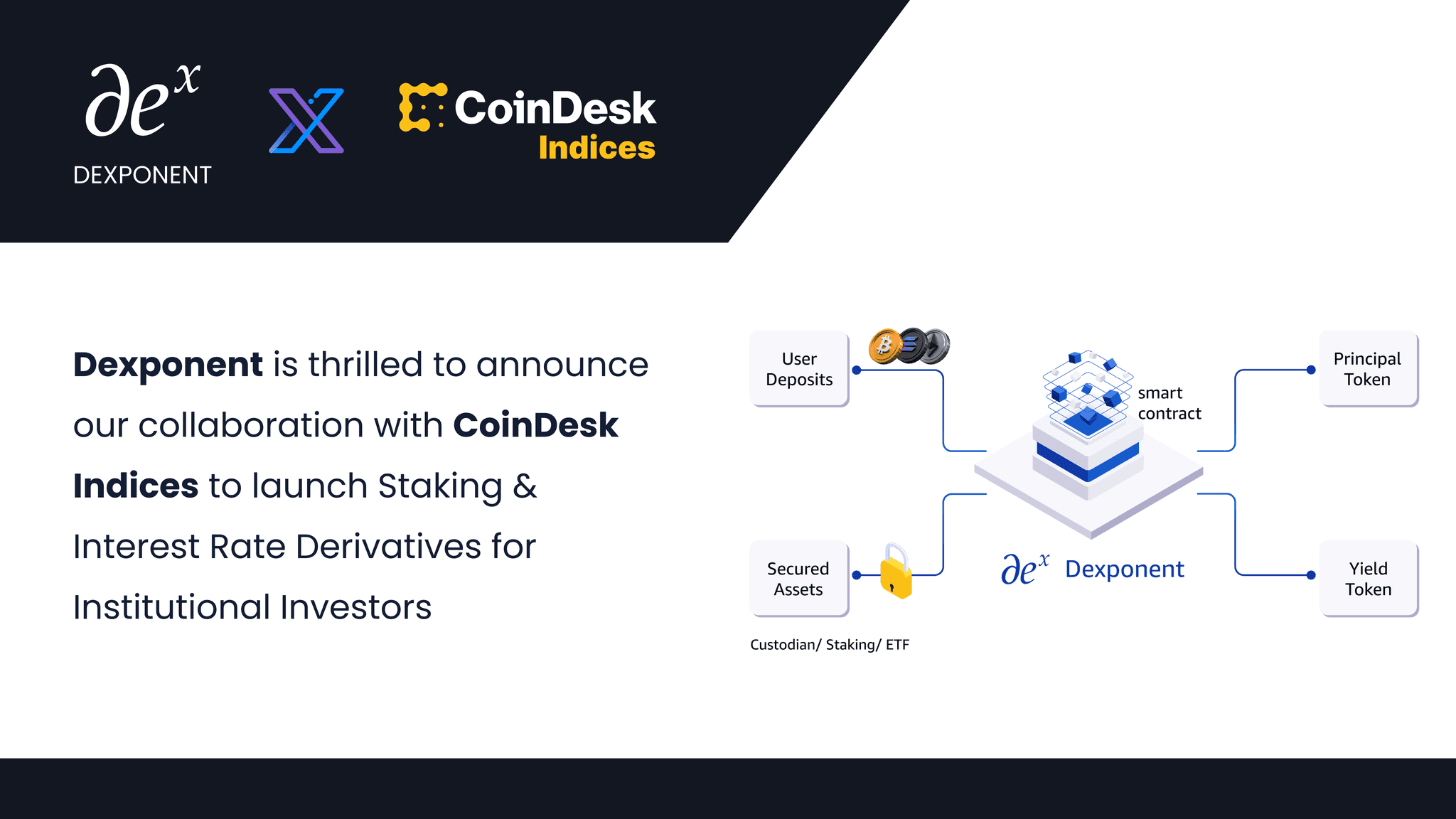

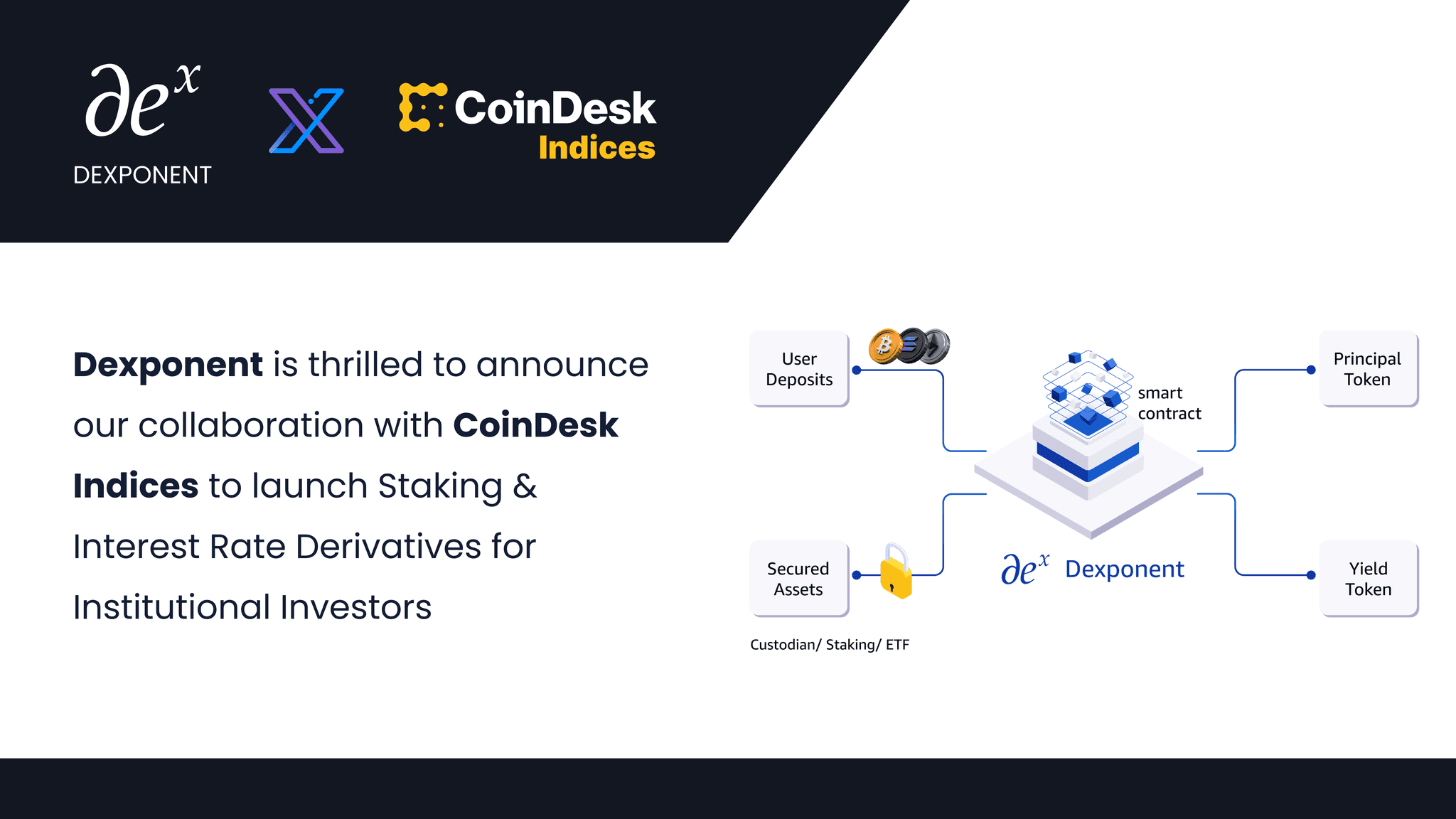

Dexponent Collaborates with CoinDesk Indices to Launch Staking and Interest Rate Derivatives Targeting Institutional Investors.

Dexponent Collaborates with CoinDesk Indices to Launch Staking and Interest Rate Derivatives Targeting Institutional Investors.

Dexponent is thrilled to announce a collaboration with CoinDesk Indices to leverage CESRTM (Composite Ethereum Staking Rate) for benchmarking on our institutionally adopted Structured Product that’s globally available.

This enhances Dexponent’s compliant staking services with multiple layers of checks, enabling clients to earn high yields with low risk. These services are insured and protected by custodians and third-party insurance, emphasizing asset protection, hack-proof security, and no counterparty risk.

Dexponent’s adoption of CESR will enhance traceability and transparency of their staking services. CESR is a benchmark rate for Ethereum staking rewards and provides participants in the Ethereum ecosystem with a standardized benchmark rate for staking and a settlement rate for derivative contracts. CESR was brought to market in 2023 by CoinFund, a leading Web3 and crypto-focused investment firm and registered investment adviser, in partnership with CoinDesk Indices, a leading provider of digital asset indices since 2014.

Innovative products by Dexponent are designed to provide institutional investors, including High Net-Worth Individuals (HNIs), Family Offices, Funds, and traditional finance companies across Asia, MENA, and Europe, with access to Ethereum staking and interest rate derivatives. This marks a significant milestone in bridging the gap between traditional finance and decentralized finance (DeFi).

With the recent surge in interest around Ethereum and the launch of Ethereum focused ETFs, institutional investors now have greater access to this leading digital asset. However, while ETFs offer exposure to Ethereum, they fall short of providing the staking yields that are crucial for maximizing returns on Ethereum holdings. Although some funds have begun to integrate staking yields into their offerings, these often come with high fees, custody risks, and suboptimal returns.

Dexponent has leveraged CESR to address these challenges with a unique approach that combines traditional fund structures with advanced on chain asset management. The joint product incorporates innovative algorithms, including MeV (Miner Extractable Value) boosts, and is benchmarked against a high quality index that blends the best of both traditional finance (TradFi) and decentralized finance (DeFi). This combination offers investors the highest returns in the market at a fraction of the cost, with no lock-up periods and full insurance protection provided by institutional-grade service providers.

The product’s structured investment and yield generation mechanism, supported by CESR, ensures a reliable and transparent investment framework. Additionally, the inclusion of interest rate derivatives allows investors to hedge against any potential asset or yield downsides, providing a comprehensive solution for managing risk.

Dexponent is thrilled to announce a collaboration with CoinDesk Indices to leverage CESRTM (Composite Ethereum Staking Rate) for benchmarking on our institutionally adopted Structured Product that’s globally available.

This enhances Dexponent’s compliant staking services with multiple layers of checks, enabling clients to earn high yields with low risk. These services are insured and protected by custodians and third-party insurance, emphasizing asset protection, hack-proof security, and no counterparty risk.

Dexponent’s adoption of CESR will enhance traceability and transparency of their staking services. CESR is a benchmark rate for Ethereum staking rewards and provides participants in the Ethereum ecosystem with a standardized benchmark rate for staking and a settlement rate for derivative contracts. CESR was brought to market in 2023 by CoinFund, a leading Web3 and crypto-focused investment firm and registered investment adviser, in partnership with CoinDesk Indices, a leading provider of digital asset indices since 2014.

Innovative products by Dexponent are designed to provide institutional investors, including High Net-Worth Individuals (HNIs), Family Offices, Funds, and traditional finance companies across Asia, MENA, and Europe, with access to Ethereum staking and interest rate derivatives. This marks a significant milestone in bridging the gap between traditional finance and decentralized finance (DeFi).

With the recent surge in interest around Ethereum and the launch of Ethereum focused ETFs, institutional investors now have greater access to this leading digital asset. However, while ETFs offer exposure to Ethereum, they fall short of providing the staking yields that are crucial for maximizing returns on Ethereum holdings. Although some funds have begun to integrate staking yields into their offerings, these often come with high fees, custody risks, and suboptimal returns.

Dexponent has leveraged CESR to address these challenges with a unique approach that combines traditional fund structures with advanced on chain asset management. The joint product incorporates innovative algorithms, including MeV (Miner Extractable Value) boosts, and is benchmarked against a high quality index that blends the best of both traditional finance (TradFi) and decentralized finance (DeFi). This combination offers investors the highest returns in the market at a fraction of the cost, with no lock-up periods and full insurance protection provided by institutional-grade service providers.

The product’s structured investment and yield generation mechanism, supported by CESR, ensures a reliable and transparent investment framework. Additionally, the inclusion of interest rate derivatives allows investors to hedge against any potential asset or yield downsides, providing a comprehensive solution for managing risk.

Dexponent’s Vision for the Future of Finance

Dexponent’s Vision for the Future of Finance

Dexponent is committed to transform the financial landscape by offering innovative, decentralized financial products that are accessible and scalable for institutional investors. The company is actively working with institutions and fintech companies worldwide to facilitate access to on-chain decentralized applications and create structured products such as yield-bearing liquid Bitcoin and liquid staking for AI infrastructure.

"We are in a very exciting period for the future of finance, where transparency and programmability are becoming the norm," said Sid Pillai, CEO of Dexponent. "With Dexponent, we are not only connecting traditional finance and DeFi, but we are also blurring the lines between technology and finance. In this new paradigm, every tech and infrastructure developer is building a financial aspect, and every financial service provider is leveraging technology and decentralized infrastructure."

"Staking rates deliver standardized benchmarks, powering the next generation of financial products, and unlocking new opportunities for institutions and consumers," said Alan Campbell, President of CoinDesk Indices. "We're thrilled to see Dexponent pioneering this space and enabling crypto-based finance."

The adoption of CESR is just the beginning of what Dexponent envisions as a transformative journey for institutional finance. By providing innovative solutions that merge the worlds of TradFi and DeFi, Dexponent is paving the way for a new era of financial products that are secure, transparent, and capable of delivering unparalleled returns.

Learn more about Dexponent’s institutionally adopted Structured Product.

Dexponent is committed to transform the financial landscape by offering innovative, decentralized financial products that are accessible and scalable for institutional investors. The company is actively working with institutions and fintech companies worldwide to facilitate access to on-chain decentralized applications and create structured products such as yield-bearing liquid Bitcoin and liquid staking for AI infrastructure.

"We are in a very exciting period for the future of finance, where transparency and programmability are becoming the norm," said Sid Pillai, CEO of Dexponent. "With Dexponent, we are not only connecting traditional finance and DeFi, but we are also blurring the lines between technology and finance. In this new paradigm, every tech and infrastructure developer is building a financial aspect, and every financial service provider is leveraging technology and decentralized infrastructure."

"Staking rates deliver standardized benchmarks, powering the next generation of financial products, and unlocking new opportunities for institutions and consumers," said Alan Campbell, President of CoinDesk Indices. "We're thrilled to see Dexponent pioneering this space and enabling crypto-based finance."

The adoption of CESR is just the beginning of what Dexponent envisions as a transformative journey for institutional finance. By providing innovative solutions that merge the worlds of TradFi and DeFi, Dexponent is paving the way for a new era of financial products that are secure, transparent, and capable of delivering unparalleled returns.

Learn more about Dexponent’s institutionally adopted Structured Product.

About Dexponent

About Dexponent

Dexponent is an institutional DeFi gateway that works with institutions to adopt and build using digital assets. With a focus on creating structured, scalable products, Dexponent is at the forefront of bridging traditional finance with the innovative capabilities of decentralized finance. Dexponent operates across Asia, MENA and UK.

To learn more about Dexponent, please visit www.dexponent.com. You can also connect with us on Twitter @Dexponentx and LinkedIn at Dexponent. For insights from our co-founder, Sid Pillai, visit his LinkedIn profile here.

Dexponent is an institutional DeFi gateway that works with institutions to adopt and build using digital assets. With a focus on creating structured, scalable products, Dexponent is at the forefront of bridging traditional finance with the innovative capabilities of decentralized finance. Dexponent operates across Asia, MENA and UK.

To learn more about Dexponent, please visit www.dexponent.com. You can also connect with us on Twitter @Dexponentx and LinkedIn at Dexponent. For insights from our co-founder, Sid Pillai, visit his LinkedIn profile here.

About CoinDesk Indices

About CoinDesk Indices

Since 2014, CoinDesk Indices has been at the forefront of the digital asset revolution, empowering investors globally. A portfolio company of the Bullish group, our indices form the foundation of the world's largest digital asset products. Known for their precision and compliance, flagships such as the CoinDesk Bitcoin Price Index (XBX) and the CoinDesk 20 Index set the industry standard for measuring, trading, and investing in digital assets. With tens of billions of dollars in benchmarked assets, CoinDesk Indices is a trusted partner. Discover more at coindeskmarkets.com.

Since 2014, CoinDesk Indices has been at the forefront of the digital asset revolution, empowering investors globally. A portfolio company of the Bullish group, our indices form the foundation of the world's largest digital asset products. Known for their precision and compliance, flagships such as the CoinDesk Bitcoin Price Index (XBX) and the CoinDesk 20 Index set the industry standard for measuring, trading, and investing in digital assets. With tens of billions of dollars in benchmarked assets, CoinDesk Indices is a trusted partner. Discover more at coindeskmarkets.com.

CoinDesk® and the Composite Ether Staking Rate (CESR®) (the “Data”) are trade or service marks of CoinDesk Indices, Inc. (“CDI”), the publisher of the Data, and/or its licensors, including CoinFund Management LLC (“CoinFund”), the owner and administrator of CESR (collectively with CDI, the “Rate Providers”). The Rate Providers own all proprietary rights in the Data. The Rate Providers do not sponsor, endorse, sell, promote or manage any investment offered by any third party that seeks to provide an investment return based on the performance of the Data (“CESR Products”). CDI is neither an investment adviser nor a commodity trading adviser and the Rate Providers make no representation regarding the advisability of making an investment in any CESR Product. The Rate Providers do not act as fiduciaries with respect to any Products. A decision to invest in any Product should not be made in reliance on any of the statements set forth in this document or elsewhere by the Rate Providers. The Rate Providers do not guarantee the accuracy, completeness, timeliness, adequacy, validity or availability of any of the Data. The Rate Providers are not responsible for any errors or omissions, regardless of the cause, in the results obtained from the use of any of the Data. The Rate Providers do not assume any obligation to update the Data following publication in any form or format. © 2024 CDI and CoinFund. All rights reserved.

CoinDesk® and the Composite Ether Staking Rate (CESR®) (the “Data”) are trade or service marks of CoinDesk Indices, Inc. (“CDI”), the publisher of the Data, and/or its licensors, including CoinFund Management LLC (“CoinFund”), the owner and administrator of CESR (collectively with CDI, the “Rate Providers”). The Rate Providers own all proprietary rights in the Data. The Rate Providers do not sponsor, endorse, sell, promote or manage any investment offered by any third party that seeks to provide an investment return based on the performance of the Data (“CESR Products”). CDI is neither an investment adviser nor a commodity trading adviser and the Rate Providers make no representation regarding the advisability of making an investment in any CESR Product. The Rate Providers do not act as fiduciaries with respect to any Products. A decision to invest in any Product should not be made in reliance on any of the statements set forth in this document or elsewhere by the Rate Providers. The Rate Providers do not guarantee the accuracy, completeness, timeliness, adequacy, validity or availability of any of the Data. The Rate Providers are not responsible for any errors or omissions, regardless of the cause, in the results obtained from the use of any of the Data. The Rate Providers do not assume any obligation to update the Data following publication in any form or format. © 2024 CDI and CoinFund. All rights reserved.

Experience the

dexponent difference

Connect with us to maximize the potential of your assets.

Contact Now →

Experience the

dexponent difference

Connect with us to maximize the potential of your assets.

Contact Now →