Onchain access to cross chain liquidity and yields

Onchain access to cross chain liquidity and yields

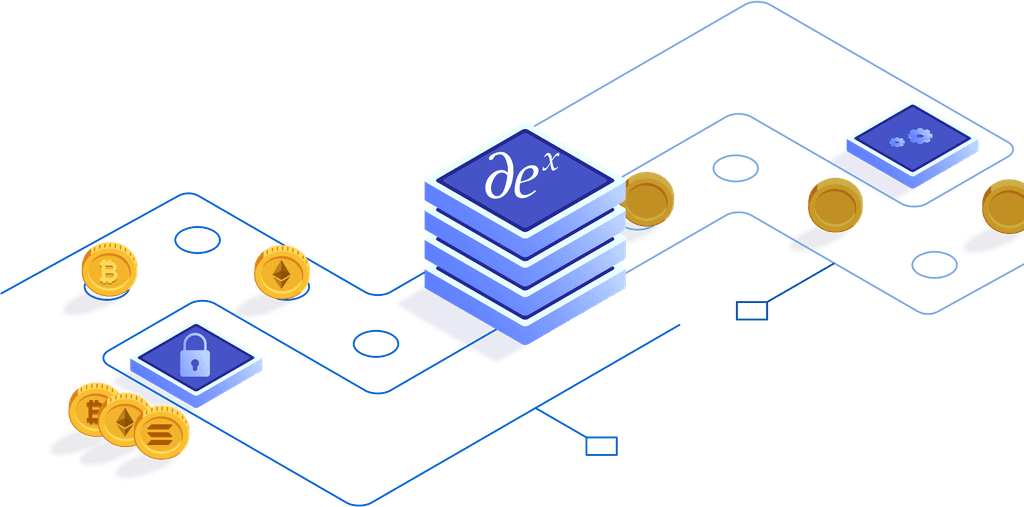

Access to onchain yields with asset and risk protection

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risk

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risk

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risk

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risk

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risks

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risks

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risks

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

01

/

03

Principal Asset

Protection

Principal Assets are protected in custodians, ETF's and Staking, with only white label wallets able to mint or burn tokens.

02

/

03

Cross Chain

Yields

Easy to build and integrate for developers and DeFi protocols

03

/

03

No Counterparty

Risks

Protected against hacks and counterparty risk using regulated custodians. Ensuring security and trust in your assets.

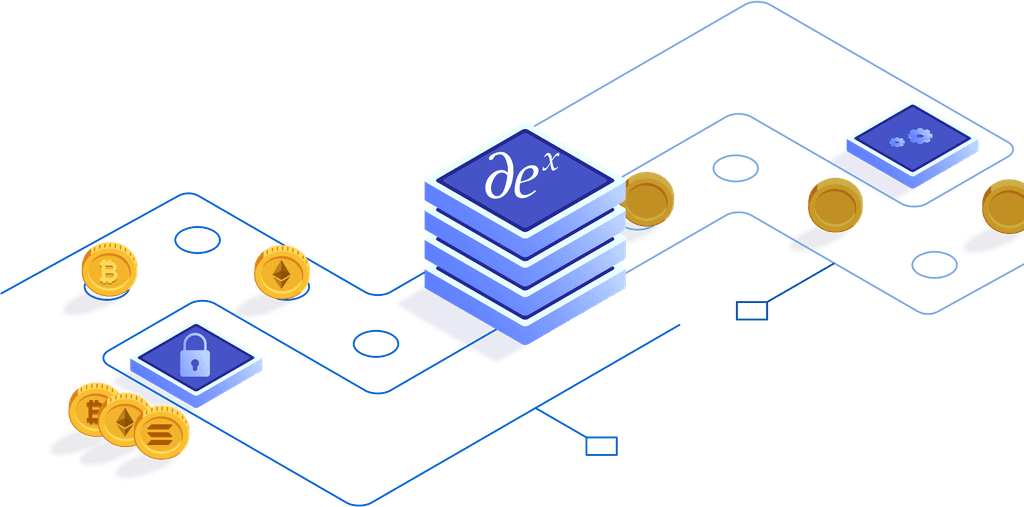

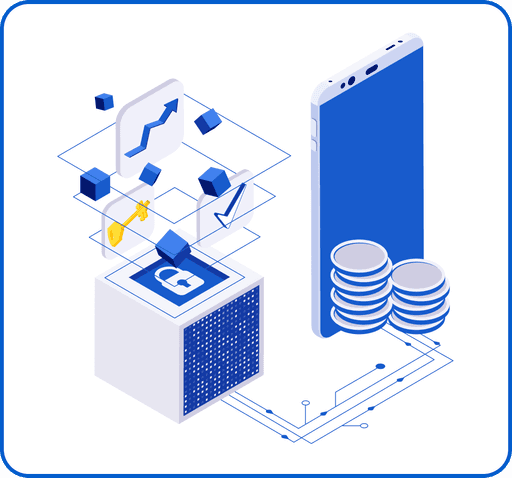

How it works?

Deposit the base asset into Dexponent’s Protocol to generate Principal Tokens and Yield Tokens

Dexponent mint's Principle Token, which is 1:1 asset pegged against the base assets, can be used in low risk strategies like Derivative Tradings, AMM Pools and Lending.

The Yield Token is generated when the base assets or the Principle Token generates any yields. The yield token can be put in high-risk and reward strategies like fair launch, restaking etc.

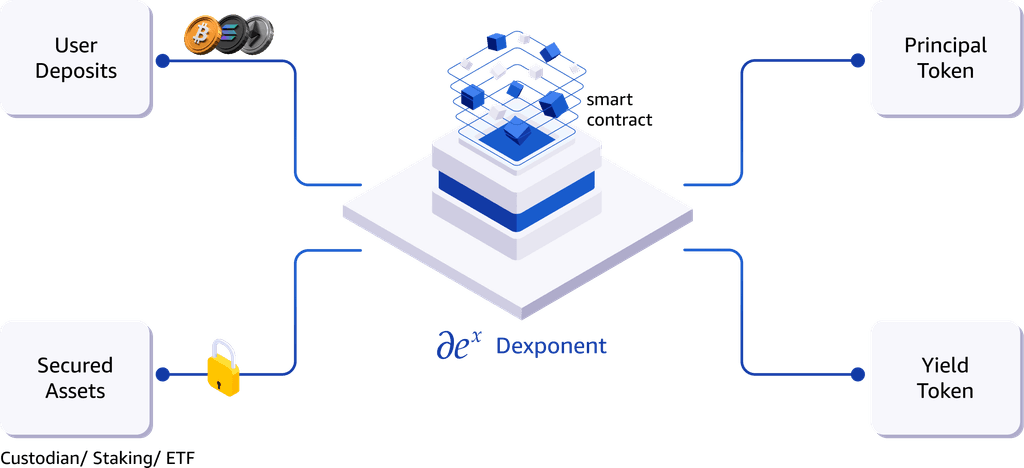

Assets Supported

Assets Supported

Enabling DeFi usage through tokens

Enabling DeFi usage through tokens

Dexponent makes it easy to access liquidity across your preferred networks - BTC, ETH, SOL & EVM Chains. We offer fast, secure and superior user interactions.

Dexponent makes it easy to access liquidity across your preferred networks - BTC, ETH, SOL & EVM Chains. We offer fast, secure and superior user interactions.

Why us?

Why us?

Core Features and Benefits

Core Features and Benefits

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

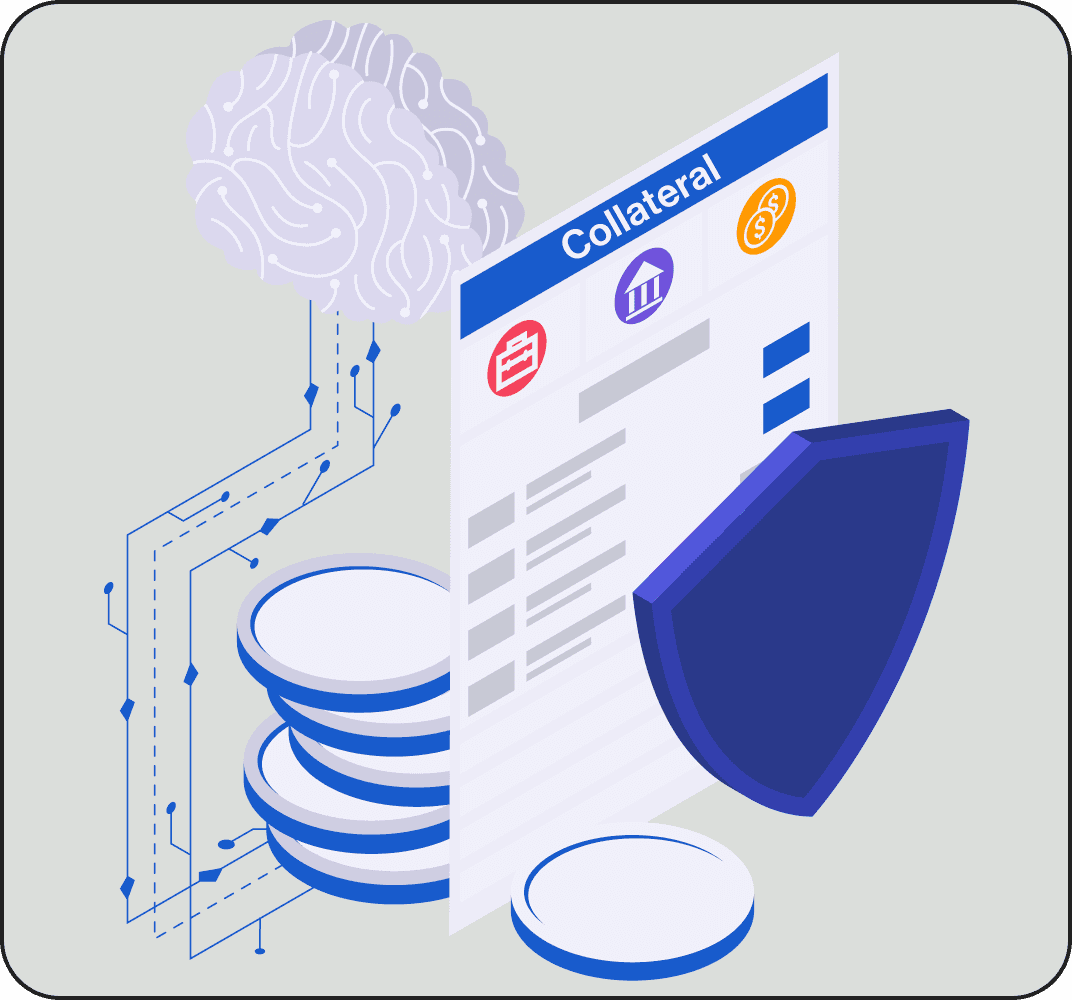

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Get the best interest rates for lending and borrowing.

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Get the best interest rates for lending and borrowing.

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Get the best interest rates for lending and borrowing.

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Get the best interest rates for lending and borrowing.

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues.

Lending & Borrowing

Enjoy Lending and Borrowing with best interest rates

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Yields

Earn yields of approximately 20% on BTC and 25% on ETH.

Collateral

Use principal tokens as collateral to receive fee rebates at trading venues

Lending & Borrowing

Get the best interest rates for lending and borrowing

Partner with us

Increase Yields and Maximize Treasuries with Us

Increase Yields and Maximize Treasuries with Us

Provide your clients with new distribution opportunities or the potential to achieve higher yields.

Custodians

Grab the opportunity to gain more customers and increase volumes.

Staking

Hedge Funds

Service Providers

Earn more with your Treasuries.

Foundations

Give your clients new distribution opportunity or potential to earn more yields

Custodians

Grab the opportunity to get more customers and volumes

Staking Hedge Funds

Service Provider

Earn more with your

Treasuries

Foundation

Build with us

Create your DeFi Platform with Dexponent

Create your DeFi Platform with Dexponent

Drives growth enabling exchanges to adapt with robust infra & easy liquidity

Exchanges

$

Powering DeFi with flexible liquidity and security.

DeFi

Improve your Fintech offerings with our fast and secure crypto ETP integrations.

FinTech

Build a modern trading platform easily with our easy liquidity solutions and innovative technology

Trading Platform

Create trading platforms with our innovative liquidity solutions.

Trading Platform

Growth with robust infrastructure, liquidity, and market adaptability.

Exchanges

$

Enhanced Fintech with our Secure Crypto ETP Integration.

FinTech

Powering DeFi with flexible liquidity and security.

DeFi

News & Insights

Learn & Educate yourself about Defi, Liquid Staking

and Investment Strategies.

Learn & Educate yourself about Defi, Liquid Staking

and Investment Strategies.

Liquid Staking

Netting is a vital process in prime brokerages that plays a critical…

Reducing Risk and ...

Decentralised Prime Brokerage

In today’s rapidly evolving financial landscape, the concept of decent…

Building Block of ...

DeFi

The development of Decentralized Finance has been a remarkable…

DeFi: Evolution, Inn...

Liquid Staking

Netting is a vital process in prime brokerages that plays a critical

Reducing Risk and ...

Decentralised Prime Brokerage

In today's rapidly evolving financial landscape, the concept of

Building Block of ….

DeFi

The development of Decentralised Finance has been a remarkable

DeFi: Evolution, Innovation…

Join our Community

Learn more about Dexponent, chat with us and have your say in the future.

Telegram

Whitepaper

Contact Us

Join our Community

Learn more about Dexponent, chat with us and have your say in the future.

How it works?

Deposit the base asset into Dexponent’s Protocol to generate Principal Tokens and Yield Tokens

Dexponent

User

Deposits

Principal

Token

Yield

Token

Secured

Assets

Custodian/ Staking/ ETF

smart

contract

Dexponent mints' Principle Token, which is 1:1 asset pegged against the base assets, can be used in low risk strategies like Derivative Tradings, AMM Pools and Lending.

The Yield Token is generated when the base assets or the Principle Token generates any yields.The yield token can be put in high risk and reward strategies like fair launch, restaking etc .